michigan sales tax exemption nonprofit

The Elusive Sales Tax Exemption for Nonprofit Organizations Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax. All fields must be.

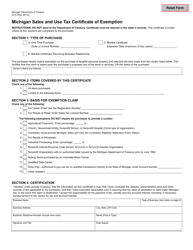

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

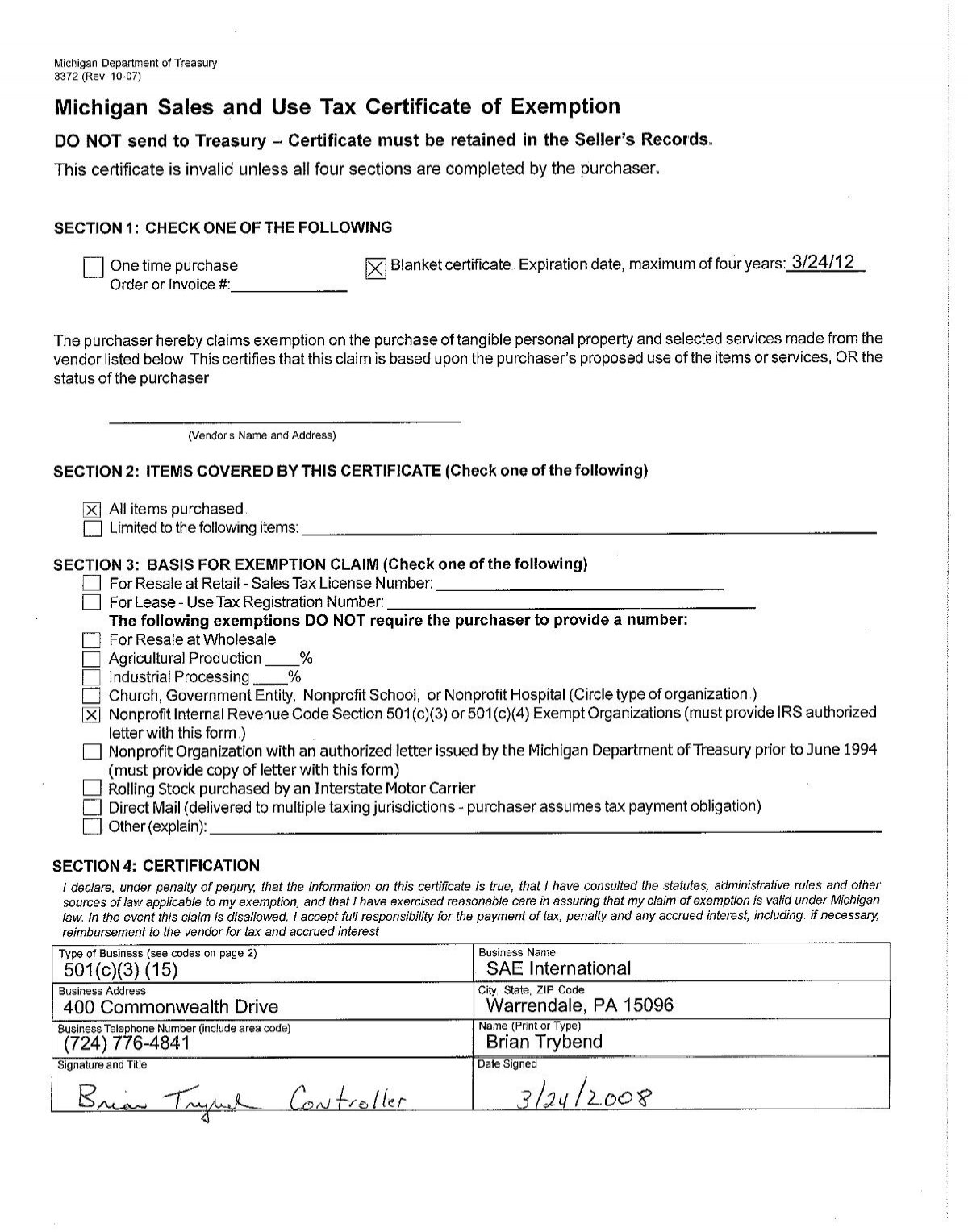

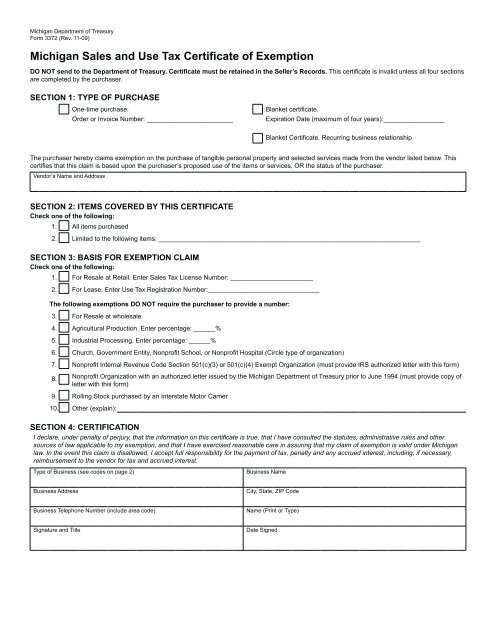

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

. Ad Standardize Taxability on Sales and Purchase Transactions. Commercial businesses in Michigan are tax-exempt for natural gas used in agricultural production. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

A A health welfare. Statement of Non-Profit - Church Synagogue or Organization. Real or personal property owned and occupied by a nonprofit charitable institution while occupied by.

Michigan 501 c 3 nonprofits are exempt from paying sales tax on purchases. Many kinds of transactions are exempt from the sales tax such as sales to nonprofit organizations churches schools farmers and industrial processors. Application for Sales Tax Exemption and Form DR-0716.

Simply put it is an exemption that exempts a residence from the tax levied by a local school district for school operating purposes up to 18 miles away. All fields must be. In order to be exempt from Michigan sales or use tax certain criteria must be met.

Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. You will need to submit a Certificate of Exemption to each vendor along with a copy of your IRS. However if provided to the purchaser in electronic.

However if provided to the purchaser in electronic. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable. Several examples of exemptions to the states sales tax are vehicles.

The rules governing them are in. An exemption from sales. RAB 2016-18 Sales and Use Tax in the Construction Industry.

The state sales tax rate is 6. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. Of Treasury must accompany a completed Michigan Sales and Use Tax Certificate of Exemption.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Colorado organizations can apply. 4q 1 A sale of tangible personal property not for resale to the following subject to subsection 5 is exempt from the tax under this act.

Ad New State Sales Tax Registration. Exemption is allowed in Michigan on the sale of rolling stock purchased by an interstate motor carrier or for. MCL 2117o1 provides Michigans property tax exemption for charities as follows.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. 100s of Top Rated Local Professionals Waiting to Help You Today. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax.

Sales Tax Exemptions Michigan information registration support. A copy of the federal exemption letter or a letter previously issued by the Michigan Dept. A copy of the federal exemption letter or a letter previously issued by this department must accompany a completed Michigan Sales and Use Tax Certificate of Exemption form 3372.

What businesses are tax-exempt in Michigan. Form 3520 Michigan Sales and Use Tax Contractor. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

They are also exempt from sales tax on the Fixed Charge if they have no use. Both unincorporated nonprofit organizations and nonprofit corporations may be exempt from some taxes. Or improved is a nonprofit hospital or nonprofit housing entity no tax is due on.

Automate Standardize Taxability on Sales and Purchase Transactions. Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit.

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Representative Makes Push To Exempt Infant Adult Diapers From Sales And Use Tax

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

Michigan Sales Tax Small Business Guide Truic

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Michigan Sales And Use Tax Certificate Of Exemption

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Mi Sales Tax Exemption Form Animart

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller